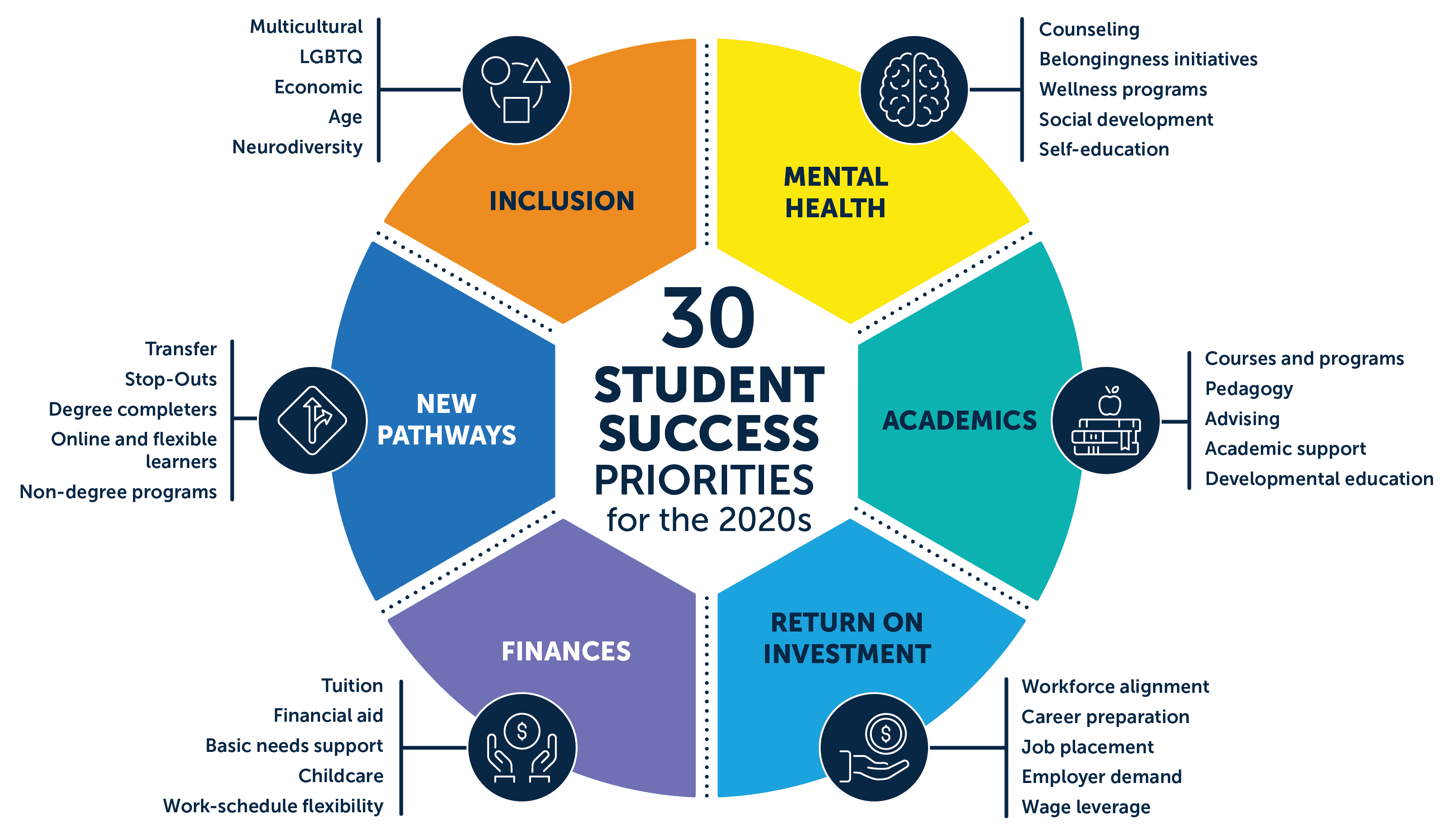

30 Student success priorities for the 2020s

October 27, 2023, By Ed Venit, Managing Director, Strategic Research

All my attention over the last two years has been spent studying the future of students and student success as we emerge from the pandemic. Notably, I am monitoring three macro trends that will converge in the mid-2020s and reshape the student success landscape. Our future will be written in large part based on how institutions respond to these challenges.

To understand these trends better, I spoke with dozens of student success leaders from two-year and four-year schools across the country asking them about their priorities in this new environment. What I learned suggests that an evolution is already underway, and their insights could serve as a roadmap for other schools to follow.

Three big trends impacting the future of student success

I see three macro trends that closely impact student success and touch nearly every institution in some way:

- First, we know that the population of traditional-age students will continue to diversify at the same time as it shrinks (the so-called “demographic cliff”). This trend will shape the composition of the students you serve while dictating the importance of retention to maintain enrollment.

- Second, confidence in the value of higher education continues its decade-long slide. Students, parents, and the public increasingly want colleges to demonstrate a tangible return on the investment of their time and money (including debt).

- Third, the impact of pandemic-era disrupted learning will continue to accelerate into the late 2020s as today’s primary and secondary students enter college. We already see concerning early signals around student mental health and math preparation.

The 30 priorities

This feels like a tough road ahead, and it is. I wanted to better understand how EAB partners were thinking about and preparing for these challenges, so I conducted a round of research interviews to hear their thoughts.

I came away with a list of 30 big student success priorities for the 2020s, which I have organized here into six thematic groups. Some of these groups were expected, while others were surprising for reasons that I will get into below. This organization is an arbitrary and rough tool for better understanding the landscape, and it is not meant to imply anything about the scope or importance of each challenge.

Each of these challenges can and will be experienced differently by different institutions. I encourage you to read with an eye toward which of them should be immediate priorities for your own institution.

New pathways

This grouping refers to the types of credentials offered by postsecondary institutions and the types of institutions that offer them. The big takeaway from this grouping is that many schools, especially small private colleges, endeavor to offset declining enrollments by exploring credential and degree types outside of their traditional ken. This move would create a new student success challenge for these institutions if they do not have the expertise and infrastructure necessary to support these new kinds of students and programs.

1. Transfers: Building pathways to transfer sources and receivers while improving the speed and quality of the credit articulation process.

2. Stopouts: Recovering lost students though a combination of special outreach and dedicated re-onboarding support to address the issues around why they left in the first place.

3. Degree completers: Recruiting “some college and no degree” students who earned credits at other institutions before leaving and are now looking to complete.

4. Online and flexible learners: Embracing the innovations that came from the forced move online during the pandemic and supporting faculty in helping these learners succeed.

5. Non-degree programs: Supporting students in shorter programs or single courses that convey value and drive enrollment from workers who want to upskill.

Finances

This grouping refers to how students pay for college and its associated cost. As might be expected, these conversations centered on longstanding concerns around tuition and financial aid, but often expanded into conversations around supporting the holistic needs of students, especially working students. Schools that begin recruiting post-traditional students should take note that they may have work to do in this area.

6. Tuition: Controlling net tuition increases and using large endowments to eliminate tuition for students from families making less than a certain amount.

7. Financial aid: Continuing to innovate with small emergency and completion grants to help students through temporary financial distress.

8. Basic needs support: Expanding food pantries and related programs to support students who have minimal financial resources.

9. Childcare: Covering a major expense and barrier to enrollment for parents, especially single mothers.

10. Work-schedule flexibility: Making support services such as advising available to working students taking classes outside of normal business hours.

Inclusion

This grouping refers to the diversity among today and tomorrow’s college students, especially as it contrasts with traditional enrollment. Unsurprisingly, multicultural diversity was a frequent topic of conversation both within the context of equity initiatives and the political climate around DEI. What was interesting was some of the other kinds of diversity that came up, especially from schools that had intentions of expanding their recruitment to new (to them) populations.

11. Multicultural: Supporting the diverse needs of students from different racial, ethnic, and international backgrounds, especially in the face of political pushback.

12. LGBTQ: Recognizing the needs and experiences of different sexual identities, with a special focus on supporting non-binary and trans students.

13. Economic: Creating a welcoming and supporting environment for students from lower income backgrounds, especially at institutions that have historically lacked economic diversity.

14. Age: Rethinking support for older and working students who may have residential needs, learning styles, and work-life challenges that differ from traditional learners.

15. Neurodiversity: Building new support structures for students with different learning and social needs stemming from their neuroarchitecture.

Mental health

This grouping refers to the rise in student mental health needs and the response of institutions to meet them. This grouping would probably not have gotten as much attention in prior years, and its inclusion at this level reflects the growing realization that mental health is the new top concern for student success leaders. This is an area where many schools feel they have a gap in service and support that needs to be closed, and many are looking to supplement their counseling services with new kinds of support.

16. Counseling: Ensuring that providers can support your students’ diverse identities and that capacity keeps up with demand, potentially relying on outsourced virtual options

17. Belonginess initiatives: Helping all students feel at home at your school and connected to a community in which they feel accepted

18. Wellness programs: Supporting the “Eight Dimensions of Wellness” through student programs and regular, positive messaging that encourages healthy behaviors and mindsets

19. Social development: Helping students develop the social skills that may have been delayed during pandemic isolation

20. Self-education: Encouraging students to explore their mental health through self-assessments and educational modules, thereby scaling and extending the efforts of counselors

Watch the Webinar: Student Success Starts with Mental Health

Academics

This grouping refers to the academic life and success of students. It is probably the least surprising grouping, given its central role in the college experience. Nevertheless, I heard a lot of conversation and concern about the struggles that post-pandemic students are experiencing in college classrooms. Forward-looking institutions have begun anticipating and preparing for a big decline in math preparation levels that we anticipate reaching colleges in the later part of the decade.

21. Courses and programs: Integrating elements of career preparation and civic engagement into curricula without losing the liberal arts ethos.

22. Pedagogy: Keeping pace with virtual and hyflex learning innovations to better meet students where they already are.

23. Advising: Adopting tandem advising models consisting of a professional advisor, a faculty member, and specialists from offices like financial aid or career advising.

24. Academic support: Preparing for the increase in demand for math tutoring and academic support later in the decade.

25. Developmental education: Implementing or expanding credit-bearing supplemental instruction models in anticipation of increased demand.

Watch On-Demand: Prepare for the Looming Math Crisis with Course Success Data

Return on investment

This grouping refers to increasing the financial value of a college degree and communicating this to stakeholders. I found this set of priorities to be the most interesting and most surprising. Demonstrating value has typically been the responsibility of a president or chancellor and is usually oriented to external audiences. What’s different now is that leaders of all altitudes are trying to demonstrate value to a different audience: their current students. They feel that they need to continuously resell their students on the value of their collegiate pursuits.

26. Workforce alignment: Aligning course skills development to emerging workforce needs, such as artificial intelligence.

27. Career preparation: Embracing career development as the primary objective of the vast majority of students and hardwiring career training into curricula.

28. Job placement: Building out connections with employers to provide students with clear pathways into the workforce.

29. Employer demand: Communicating with local employers to showcase institutional strengths and encourage them to hire more graduates.

30. Wage leverage: Competing with high hourly wages by showing students a clear ROI on their investment of time and money.

Technology is needed to scale many priorities

I spoke about three macro trends above, but there is actually a fourth macro trend that is influencing our ability to respond to change, and this one is in our favor. The generational makeup of college faculty, staff, and administrators is changing as Boomers move into retirement and tech-friendly Gen X fills out the senior cabinet. These new leaders will be supported by digital-native Millennials and eventually mobile-native Gen Zs, both of whom grew up with modern technology and are used to applying it to solve challenges.

This is very good news, because technology is going to be necessary to overcome our persistent staffing limitations. A common thread running through my conversations was the large number of open student success roles that many campuses are still experiencing. This is especially concerning in already capacity constrained areas like advising.

In this environment, you will need technology to make progress against most of the priorities above. In particular, the priorities clustered around mental health and wellness, inclusion, and academic advising and support, can be supported by student success CRM technologies like Navigate360. We are also bullish that data platforms like Edify will enable a more sophisticate understanding of college ROI. Finally, artificial Intelligence is obviously a big wild card. EAB is actively exploring how to incorporate AI into our student success technologies.

More Blogs

What can we learn from first-year GPA?

What major switching can tell us about student outcomes